1031 EXCHANGE INVESTMENTS

Complete Your 1031 Exchange

Invest your 1031 Exchange proceeds alongside leading institutions in personalized, diversified portfolios of properties designed for income generation and value appreciation.

Designed for income generation and value appreciation.

Flexible holding periods and exit options.

Custom, diversified portfolios designed by experts.

Trending 1031 Exchange Investments

Explore past and illustrations of investment opportunities from Baker 1031 Funds. To access the latest available investment properties, get started!

Why Experienced Investors Choose Baker 1031 Funds

When it comes to your 1031 Exchange, you have a lot of investment options. We believe our firm, investment opportunities, and platform set us apart.

Our offerings are 100% passive, making it possible to invest in any property type without the headaches of expenses, tenants, and management.

You only need to invest your 1031 Exchange proceeds. Unlike other options, you don't need to contribute additional capital to complete your 1031 Exchange.

Assumable financing is available if you need to replace debt as part of your 1031 Exchange. No application or approval is required.

Our investments are structured to provide you with monthly income, full tax benefits, and your share of the sale proceeds.

We handle the entire 1031 Exchange process for you and can complete your transaction in as quick as 2-3 days.

Your 1031 Exchange. Our Solutions.

Income & Growth

Use DSTs to invest alongside leading institutions in properties designed to generate income and grow overall value. Investors are entitled to your share of rental revenue, value appreciation, and tax benefits.

Personalized Service

Unlike other firms, we craft personalized, passive real estate portfolios for your 1031 Exchange. Also, you work directly with the firm’s founder - no middlemen or inexperienced employees.

Singular Solution

Instead of being forced to invest in a single property, you can invest in a DST that exactly matches your exchange equity and debt requirements. This simplifies your 1031 process and maximizes tax deferral benefits.

Diversification

DSTs allow you to diversify your real estate holdings across property types, geographies, and tenants. This diversification minimizes risk and potentially enhances returns.

Income Protection

By spreading your investment across multiple properties and tenants, you reduce the risk of a single vacancy significantly impacting your cash flow.

Rigorous Due Diligence

Our multi-layered due diligence process ensures clients are presented with highly-vetted investment opportunities from reputable Sponsors.

REALIZED INVESTMENT

Florida Apartment Portfolio

Inland, a sponsor on the Baker 1031 Funds platform, has sold three multifamily properties for approximately $192.8 million. The sale resulted in a total return to investors of 287.71% and an average annual return of 29.19%.

20.16% Annualized IRR

2.92x Equity Multiple

6.42 Year Holding Period

REALIZED INVESTMENT

Silicon Valley eBay Campus

Sun Microsystems originally leased the property and was ultimately re-tenanted by eBay. The Sponsor, Net Lease Capital, provided investors with a 3.97x equity multiple upon sale.

3.97x Equity Multiple

$100MM+ Offering

8 Year Holding Period

REALIZED INVESTMENT

Tampa, FL Westin Hotel

Peachtree Group, a Sponsor on the Baker 1031 Funds platform, offered investors the opportunity to participate in a Tampa, Florida Westin Hotel.

61.90% Annualized IRR

2.51x Equity Multiple

Less Than 1 Year Holding Period

[email protected] | +1 (844) 787-1031

Learn more about us on BrokerCheck.

The information herein has been prepared for educational purposes only and does not constitute an offer to purchase or sell securitized real estate investments. Such offers are only made through the Sponsor’s Private Placement Memorandum (PPM) which is solely available to accredited investors and accredited entities. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence) and accredited entities only. If you are unsure if you are an accredited investor and/or an accredited entity, please verify with your CPA and Attorney.

There are material risks associated with investing in DST properties and real estate securities including liquidity, tenant vacancies, general market conditions and competition, lack of operating history, interest rate risks, the risk of new supply coming to market and softening rental rates, general risks of owning/operating commercial and multifamily properties, short term leases associated with multi-family properties, financing risks, potentially adverse tax consequences, general economic risks, development risks, long hold periods, and potential loss of the entire investment principal. Potential cash flows/returns/appreciation are not guaranteed and could be lower than anticipated. Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk. Because investor situations and objectives vary this information is not intended to indicate suitability for any particular investor. This material is not to be interpreted as tax or legal advice. Please speak with your own tax and legal advisors for advice/guidance regarding your particular situation.

Securities offered through Aurora Securities, Inc. (ASI), member FINRA / SIPC. Baker 1031 Investments (Baker 1031) is independent of ASI. To access Aurora Securities’ Form Customer Relationship Summary (CRS), please click HERE. Baker 1031 Investments and ASI do not offer legal or tax advice. Please consult the appropriate professional regarding your individual circumstances.

Client examples are hypothetical and for illustration purposes only. Individual results may vary.

This site is published for residents of the United States only. Representatives may only conduct business with residents of the states and jurisdictions in which they are properly registered. Therefore, a response to a request for information may be delayed until appropriate registration is obtained or exemption from registration is determined. Not all services referenced on this site are available in every state through every advisor listed.

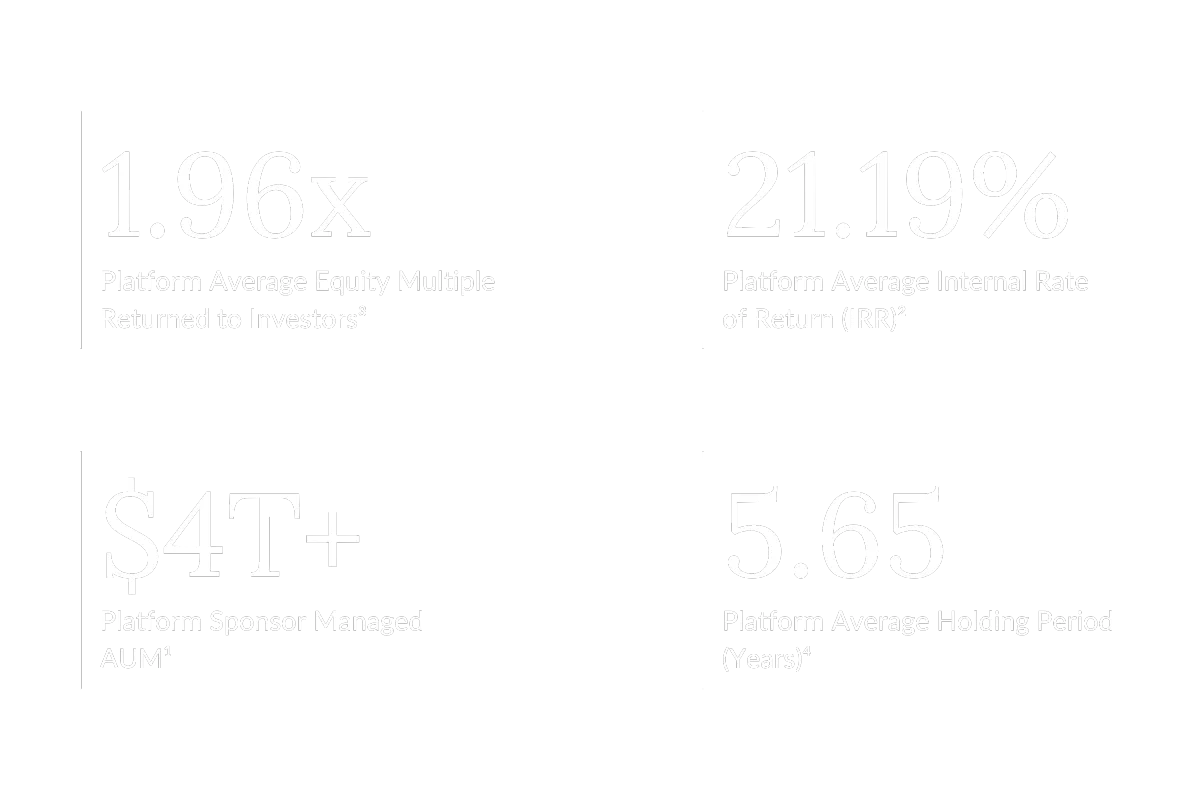

¹Platform AUM includes all Sponsors on the Aurora Securities DST platform including: Blue Owl, Bluerock, Brookfield, Cantor Fitzgerald, Capital Square, Carter Exchange, ExchangeRight, Inland, and Invesco.

²Average Platform IRR is based on a selection of realized investments from Sponsors available on the Aurora Securities DST platform. Selection of realized investments represented was based on availability of data and removal of special situations that may affect the outcome including 721 Exchanges. Represented Sponsors include Bluerock, Capital Square, Four Springs, Net Lease Capital, and NexPoint. Past performance is not indicative of future performance.

³Average Platform Equity Multiple is based on a selection of realized investments from Sponsors available on the Aurora Securities DST platform. Selection of realized investments represented was based on availability of data and removal of special situations that may affect the outcome including 721 Exchanges. Represented Sponsors include Bluerock, Capital Square, Four Springs, Net Lease Capital, and NexPoint. Past performance is not indicative of future performance.

⁴Average Platform Holding Period is based on a selection of realized investments from Sponsors available on the Aurora Securities DST platform. Selection of realized investments represented was based on availability of data and removal of special situations that may affect the outcome including 721 Exchanges. Represented Sponsors include Bluerock, Capital Square, Four Springs, Net Lease Capital, and NexPoint. Past performance is not indicative of future performance.